A Biased View of Pkf Advisory Services

A Biased View of Pkf Advisory Services

Blog Article

Pkf Advisory Services Fundamentals Explained

Table of ContentsNot known Incorrect Statements About Pkf Advisory Services 10 Simple Techniques For Pkf Advisory ServicesThe Greatest Guide To Pkf Advisory ServicesHow Pkf Advisory Services can Save You Time, Stress, and Money.The Ultimate Guide To Pkf Advisory Services

Knowing that you have a strong monetary strategy in area and specialist guidance to turn to can reduce stress and anxiety and enhance the lifestyle for several. Broadening accessibility to economic suggestions might likewise play a crucial role in reducing wide range inequality at a social level. Commonly, those with reduced revenues would benefit the most from monetary support, however they are also the least likely to afford it or know where to seek it out.Traditional monetary advice models usually served wealthier individuals in person. Versions of monetary recommendations are currently usually hybrid, and some are also digital-first.

Pkf Advisory Services - Questions

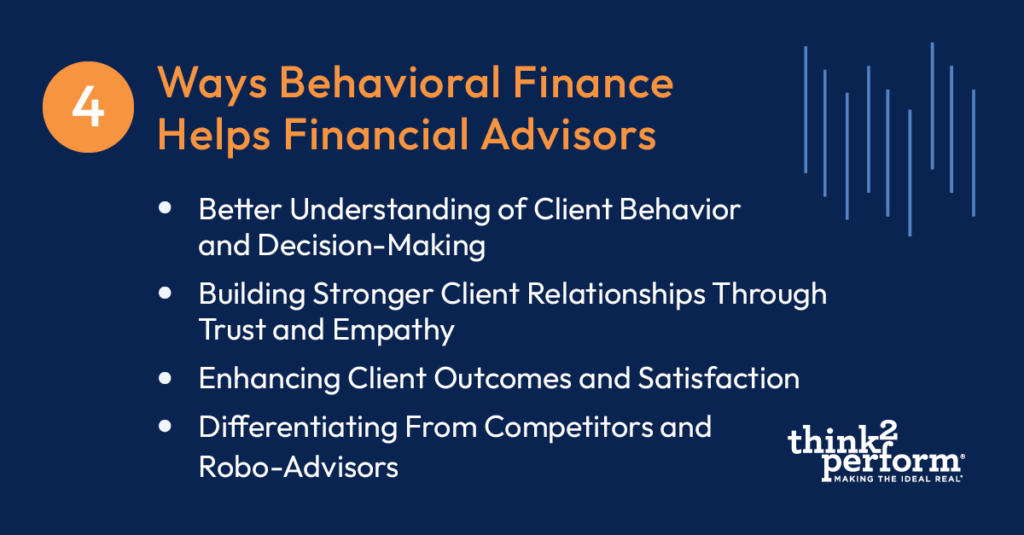

There is now a developing breadth of suggestions models with a range of pricing frameworks to fit a slope of customer demands. Another considerable obstacle is an absence of rely on monetary advisors and the guidance they provide. As an example, in Europe, 62% of the grown-up populace is not certain that the investment advice they obtain from their financial institution, insurer, or monetary consultant is in their benefit.

The future explained below is one where economic well-being is accessible for all. It is a future where monetary suggestions is not a luxury but a vital solution obtainable to everyone. The benefits of such a future are far-ranging, but we have a long method to head to reach this vision.

Marital relationship, divorce, remarriage or simply relocating with a brand-new companion are all milestones that can call for cautious planning. As an example, together with the usually difficult emotional ups and downs of divorce, both partners will need to handle essential monetary factors to consider. Will you have adequate revenue to sustain your way of life? Exactly how will your investments and other assets be divided? You might extremely well need to change your monetary method to keep your view it objectives on the right track, Lawrence states.

An unexpected increase of money or assets increases immediate inquiries about what to do with it. "A monetary advisor can aid you believe with the ways you might put that money to work towards your personal and financial objectives," Lawrence says. You'll want to assume regarding exactly how much could most likely to paying down existing debt and just how much you might think about investing to go after a more safe and secure future.

Pkf Advisory Services Things To Know Before You Get This

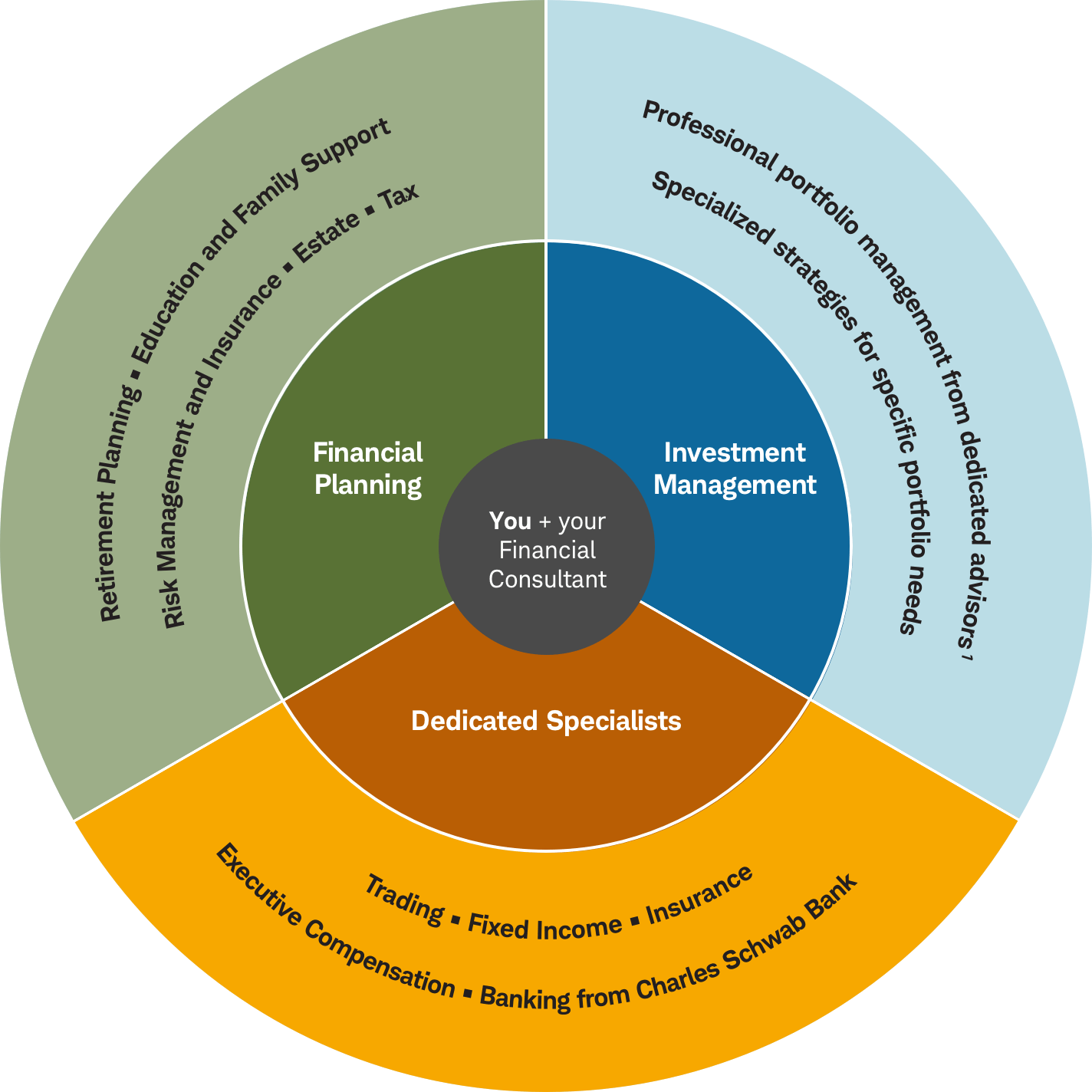

No two individuals will certainly have fairly the same collection of investment approaches or services. Depending upon your objectives along with your resistance for danger and the moment you need to seek those objectives, your advisor can help you determine a mix of financial investments that are appropriate for you and created to aid you reach them.

An essential benefit of producing a strategy is having a detailed sight of your financial situation. When life modifications and you struck a bump on you could try these out your financial roadmap, it's easy to obtain off track.

6 Easy Facts About Pkf Advisory Services Shown

Will I have enough conserved for retired life? A comprehensive, written strategy provides you a clear picture and instructions for ways to reach your objectives.

It is for that reason not surprising that amongst the respondents in our 2023 T. Rowe Rate Retirement Financial Savings and Spending Research, 64% of baby boomers reported modest to high levels of stress and anxiety regarding their retired life cost savings. When preparing for retired life, individuals might benefit from academic resources and digital experiences to aid them draft an official strategy that describes expected expenses, earnings, and property management strategies.

Developing a formal written plan for retired life has actually revealed some vital benefits for preretirees, consisting of boosting their confidence and excitement regarding retired life. Most of our preretiree study participants were either in the procedure of developing a retired life plan or assuming regarding it. For preretirees that were within 5 years of retirement and for retired people in the 5 years after their retired life date, data showed a purposeful increase in formal retirement preparation, consisting of looking for aid from a monetary expert (Fig.

Facts About Pkf Advisory Services Uncovered

Preretirees might discover value in a range of solutions that will certainly assist them plan for retired life. These can consist additional hints of specialized education to help with the withdrawal and revenue stage or with essential choices such as when to accumulate Social Safety.

Report this page